What are Financial statements? Financial statements are written reports that summarize a company’s financial performance and activities. They include information on what the company owns and owes, how much money it has made and spent, and its financial position. Management prepares financial statements for a company each quarter, each six-month period, and each year. To ensure accuracy, government agencies, accountants, and firms often audit them.

Importance of financial statements to businesses

Financial statements can help businesses:

- Track financial results and identify profitability concerns

- Determine how the company generates cash, where the money comes from, and how it uses the money

- Determine whether a business has the capability to pay back its debts

- Identify areas where they can cut costs, places where they can invest more, and make decisions on whether or not to expand

- Better manage debt

- Know what products are selling well, what segments are growing well, and which segment of business needs further review and re-investment or complete exit

Importance of financial statements to investors

Financial statements provide investors with information about a company’s financial health, including its revenue, expenses, profitability, and debt load. This information can help investors determine how much to invest in a company and at what price per share.

Financial statements can also help investors.

- Assess a company’s ability to generate profits and grow at a sustainable rate

- Assess a company’s risk level

- Identify potential investment opportunities

- Analyze trends

- Make cash flow projections

- Compare a company’s numbers to its competitors

What Do Financial Statements Tell You?

Financial statements can tell you a lot about a company, including:

- How much money the company is making or losing.

- How much debt the company has.

- How much money the company has in cash and other liquid assets.

- How efficiently the company is using its assets.

- How profitable the company is.

- How likely the company is to repay its debts.

Three Major Financial Statements are:

- Income statements

- Balance sheets

- Cash flow statements

Income statements ⬇

Show how much money a company makes and spends in a given period. They illustrate the company’s profitability.

Balance sheets ⬇

Show a company’s assets, liabilities, and shareholders’ equity at a particular point in time. They provide a snapshot of a company’s finances.

Cash flow statements ⬇

shows the company’s cash inflows and outflows during a period of time. They show cash movements from operating, investing, and financing activities.

The three statements are linked. The net income from the income statement feeds into retained earnings (earning surplus) on the balance sheet. It is also the starting point for the cash from operations section on the cash flow statement.

Summary comparison of the three financial statements in a table:

| Financial Statement | Purpose | Focus |

|---|---|---|

| Income Statement | Shows the company’s revenues and expenses over a period of time. | Profitability |

| Balance Sheet | Shows the company’s assets, liabilities, and shareholder equity at a point in time. | Financial position |

| Cash Flow Statement | Shows the company’s cash inflows and outflows over a period of time. | Liquidity |

Which financial statement is most important to shareholders?

The most important financial statement for shareholders is the income statement. This statement shows how much money the company made or lost during a period of time, typically a quarter or a year. The income statement is important for shareholders because it shows how much profit the company is generating for them.

The other two main financial statements are the balance sheet and the cash flow statement. The balance sheet shows the company’s assets, liabilities, and shareholder equity at a point in time. The cash flow statement shows the company’s cash inflows and outflows during a period of time. These statements are also important for shareholders, but they are not as important as the income statement.

How to read financial statements

To read financial statements, you need to understand the key terms and concepts that are used. Here are some of the most important terms:

- Revenue: This is the amount of money that the company generates from its sales.

- Expenses: These are the costs that the company incurs in order to operate its business.

- Net income: This is the company’s profit after all expenses have been deducted.

- Assets: These are the things that the company owns, such as cash, inventory, and property.

- Liabilities: These are the things that the company owes, such as debt and accounts payable.

- Shareholder equity: This is the amount of money that the company’s shareholders have invested in the company.

- Earnings per share (EPS): This is the company’s net income divided by the number of outstanding shares.

- Debt-to-equity ratio: This ratio shows how much debt the company has compared to its equity. A higher debt-to-equity ratio means that the company is more leveraged.

- Return on equity (ROE): This ratio shows how much profit the company generates for its shareholders. A higher ROE means that the company is more profitable.

Once you understand the key terms, you can start to read the financial statements. Here are some tips for reading financial statements:

- Start with the income statement. This statement will give you an overview of the company’s profitability.

- Then, look at the balance sheet. This statement will give you a snapshot of the company’s financial position.

- Finally, read the cash flow statement. This statement will tell you how the company is generating and using cash.

- Compare the company’s results to its competitors and to its own historical results. This will help you identify any trends that may be affecting the company’s performance.

- Read the management commentary. This section of the financial statements provides commentary from the company’s management on the results and outlook.

Financial Statements examples : A Beginner’s Guide to Reading the Financial Statements of Company

This article provides a beginner’s guide to reading the financial statements of a company. It uses the financial statements of Mazagon Dock Shipbuilders Limited (MDL) as an example. MDL is a public limited company that is listed on BSE and NSE. It is a leading shipbuilder in India and has a long history of operations.

Income Statement

The income statement is the first financial statement that you should read. It shows the company’s revenue, expenses, and net income for the period.

- Revenue: This is the amount of money that the company generates from its sales. In the case of Mazagon Dock Shipbuilders, revenue comes from the construction and repair of ships.

- Expenses: These are the costs that the company incurs in order to operate its business. They include things like cost of material consumed, selling and distribution expenses, and administrative expenses.

- PAT: This is the company’s profit after all expenses have been deducted. In the case of Mazagon Dock Shipbuilders, Net profit for FY 2022-23 was ₹1,118.92 crore.

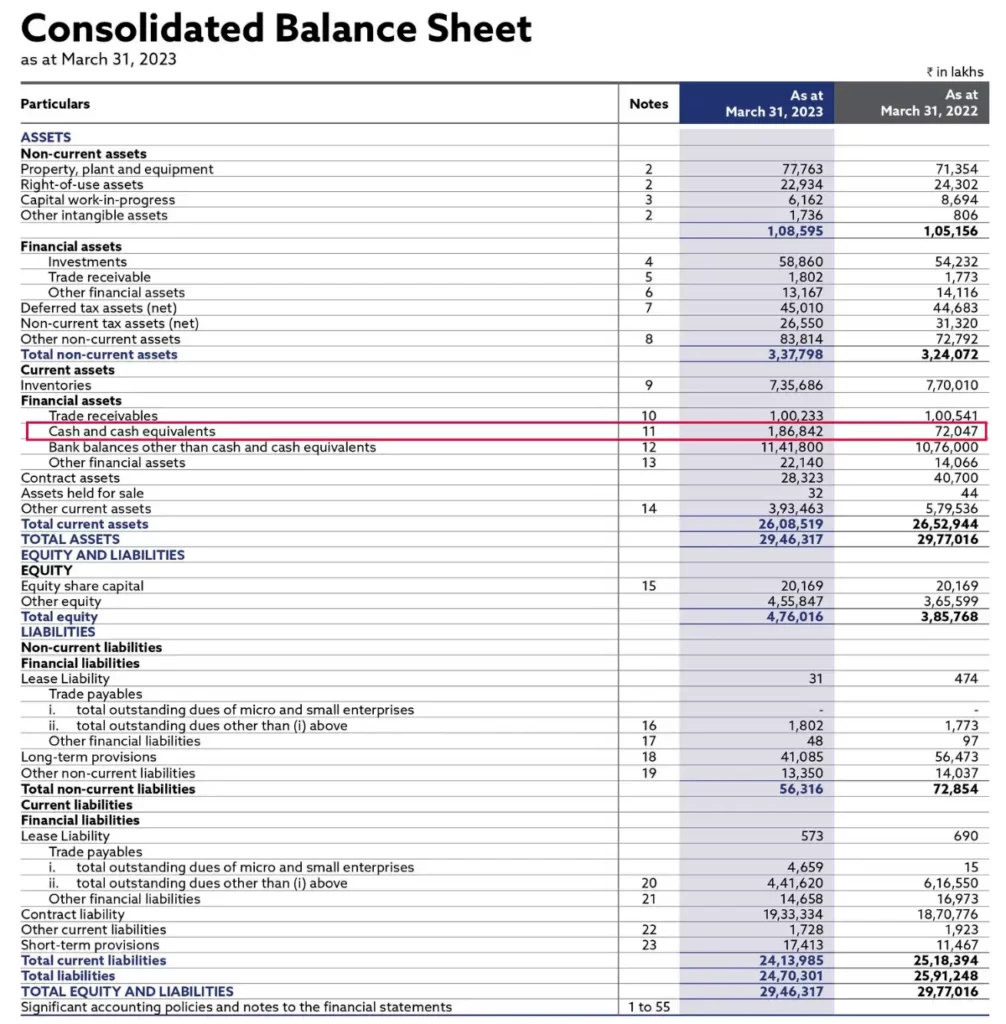

Balance Sheet

The balance sheet shows the company’s assets, liabilities, and shareholder equity at a point in time.

- Assets: These are the things that the company owns, such as cash, inventory, and property. In the case of Mazagon Dock Shipbuilders, assets as of March 31, 2023 were ₹29,463.17 crore

- Liabilities: These are the things that the company owes, such as debt and accounts payable. In the case of Mazagon Dock Shipbuilders, liabilities as of March 31, 2023 were ₹24,703.01 crore.

- Shareholder equity: This is the amount of money that the company’s shareholders have invested in the company. In the case of Mazagon Dock Shipbuilders, shareholder equity as of March 31, 2023 was ₹4,760.16 crore.

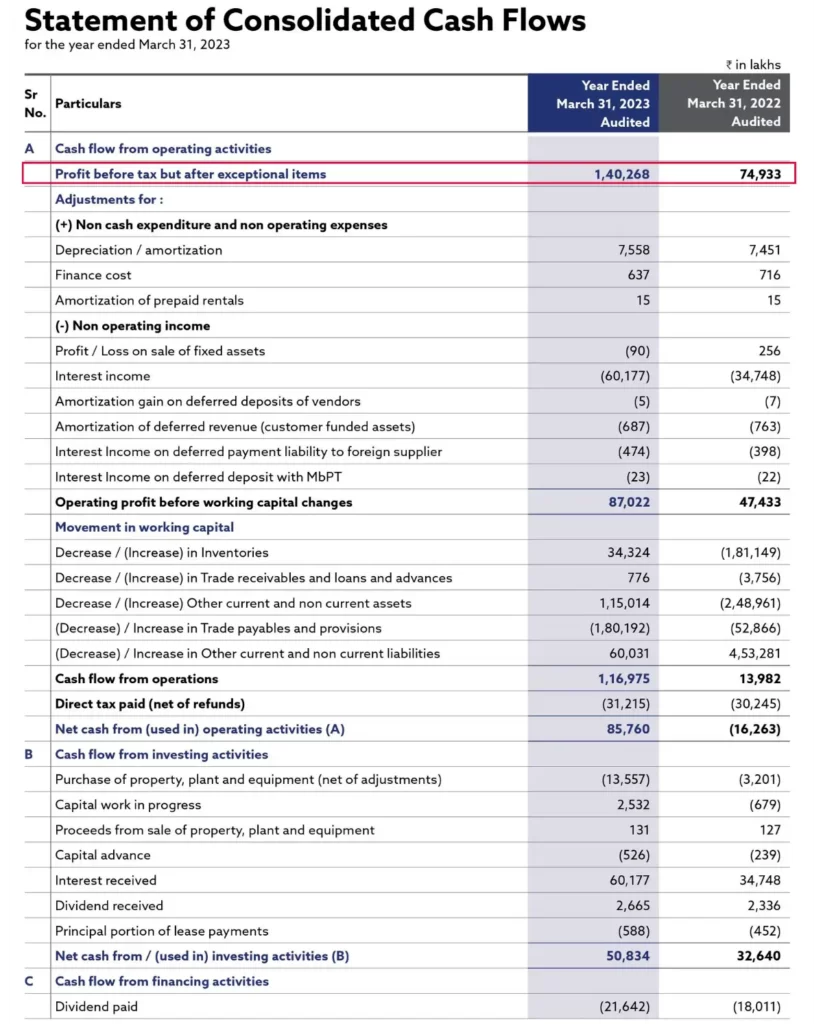

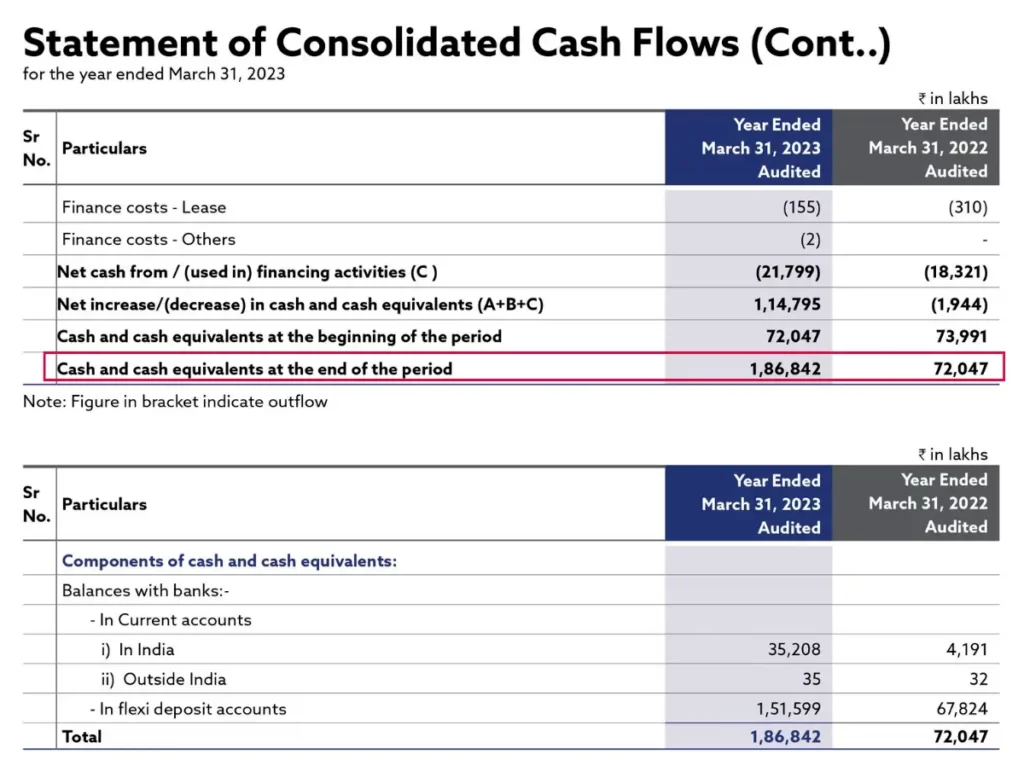

Cash Flow Statement

The cash flow statement shows the company’s cash inflows and outflows for the period. It is a useful statement to see how the company is generating and using cash.

- Cash from operations: This is the cash that the company generates from its operating activities, such as selling products and collecting accounts receivable. In the case of Mazagon Dock Shipbuilders, cash from operations for FY 2022-23 was ₹857.60 crore.

- Cash from investing activities: This is the cash that the company generates from its investing activities, such as buying and selling property, plant, and equipment. In the case of Mazagon Dock Shipbuilders, cash from investing activities for FY 2022-23 was ₹508.34 crore.

- Cash from financing activities: This is the cash that the company generates from its financing activities, such as issuing debt or equity. In the case of Mazagon Dock Shipbuilders, cash from financing activities for FY 2022-23 was ₹(-217.99) crore

- Net Cash Flow ₹1868.84 crore

Management Commentary

The management commentary is a section of the financial statements where the company’s management discusses the results and outlook. This can be a valuable source of information about the company’s plans and challenges.

In the management commentary for FY 2022-23, Mazagon Dock Shipbuilders management highlighted the following key points:

- The company’s revenue grew by 36.52% to ₹7,827.18 crore.

- The company’s net income grew by 83.14% to ₹1118.92 crore.

- The company’s order book stood at ₹39,438 crore as of March 31, 2023.

Peer comparison

Here is a comparison of Mazagon Dock Shipbuilders (MDL) with its peers:

It is important to note that no single financial statement can tell the whole story about a company. Shareholders should also consider other factors, such as the company’s management team, its competitive landscape, and the economic environment, when making investment decisions.

In conclusion, financial statements are a valuable tool for investors and creditors to assess a company’s financial health. By understanding the three main financial statements and some of the key ratios, you can get a good understanding of a company’s financial position and performance.

FAQ on financial statements

Where can I download company financial statements for free?

The company’s website: Most listed companies have investor relations section on their website where they post their financial statements.

Exchange websites: BSE website , NSE website

Financial websites: There are a number of financial websites like Screener, Money C ontrol , Value Research online , Capital Market etc. that provide financial statements of Indian listed companies.

What is the difference between standalone and consolidated financial statements?

Standalone financial statements show the financial position of a parent company and do not include its subsidiaries. While consolidated financial statements include the financial performance of a parent company along with its joint ventures, associate companies, and subsidiaries.

Standalone statements can be tricky because a parent company may be thriving and debt-free, but its subsidiaries may be in debt. Consolidated statements show a truer picture of what is actually going on.

Things to keep in mind when reading financial statements?

Here are the things to keep in mind when reading financial statements:

1. Financial statements are historical documents. They do not necessarily reflect the company’s future performance.

2. It is important to compare the company’s financial statements to its competitors and to industry averages.

3.It is also important to read the management commentary to get a better understanding of the company’s operations and challenges.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. The information contained in this article is based on the author’s personal experience and knowledge, and may not be applicable to all situations. The author disclaims any liability for any loss or damage, whether direct or indirect, arising from the use of this article. The author is not a financial advisor and is not qualified to provide financial advice. Readers should consult with a financial advisor before making any investment decisions.