An initial public offering (IPO) is the first time that a company offers its shares to the public. It is a way for the company to raise capital and become more widely known. IPO process in India is regulated by the Securities and Exchange Board of India (SEBI).

This article will provide a detailed guide to the IPO process in India. We will cover all of the steps involved, from appointing a merchant banker to listing the shares on the stock exchanges to Post-IPO reporting.

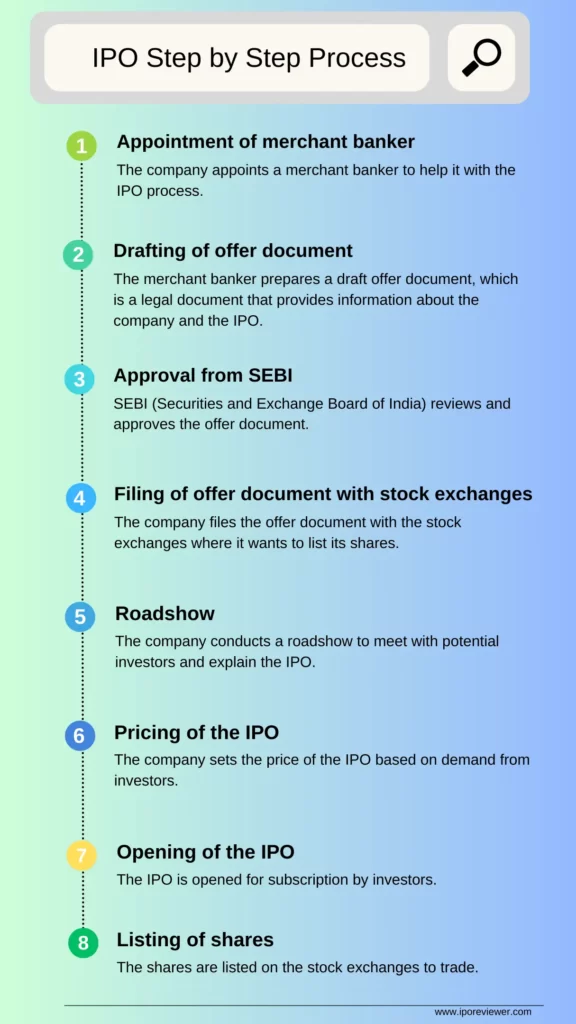

The following are the steps involved in the IPO process in India:

Step 1: Appointment of merchant banker

The company appoints a merchant banker to help it with the IPO process. A merchant banker is a financial institution that is licensed by SEBI to advise companies on IPOs.

Step 2: Drafting of offer document

The merchant banker prepares a draft offer document, which is a legal document that provides information about the company and the IPO. The offer document must include information about the company’s business, financial performance, management team, and risks associated with the investment.

Step 3: Approval from SEBI

SEBI reviews and approves the offer document. The SEBI will consider the following factors when approving an IPO: the company’s financial performance, the management team’s experience, and the risks associated with the investment.

Step 4: Filing of offer document with stock exchanges

The company files the offer document with the stock exchanges where it wants to list its shares. The stock exchanges will review the offer document and may ask the company to provide additional information.

Step 5: Roadshow

The roadshow is a series of presentations that the company makes to potential investors. The roadshow is an opportunity for the company to generate interest in the IPO and to answer investor questions.

Step 6: Pricing of the IPO

The company sets the price of the IPO based on demand from investors. In an IPO, the price is usually determined by a process called Bookbuilding or Fixed price. In Bookbuilding, investors submit bids for the number of shares they want to buy and the price they are willing to pay. The company then sets the price of the IPO at a level that will meet the demand from investors.

Step 7: Opening of the IPO

The IPO is opened for subscription by investors. Investors can apply for shares.

Step 8: Listing of shares

The shares are listed on the stock exchanges. The shares are then traded on the stock exchanges, and investors can buy and sell them just like any other stock.

Step 9: Post-Listing Obligations

In the last step, companies undertake post-listing obligations, including the submission of periodic reports to regulatory bodies like SEBI and the stock exchange. These obligations encompass adhering to corporate governance standards, promptly disclosing material events, and more. These actions are aimed at upholding transparency and accountability, benefiting both shareholders and stakeholders.

Conclusion

In conclusion, the IPO process in India represents a significant milestone for companies seeking to raise capital and expand their horizons. It is a complex yet rewarding journey that involves meticulous planning, regulatory compliance, and a commitment to transparency and accountability.

As we’ve explored in this step-by-step guide, going public in India involves several crucial stages, from the preparation phase to the post-listing obligations. Companies that successfully navigate this process can not only access much-needed funds but also gain exposure, credibility, and the opportunity for future growth.

For investors, IPOs offer a chance to invest in promising companies early in their journey and potentially reap substantial returns. However, it’s essential for investors to conduct thorough due diligence and assess the risks and rewards associated with each IPO opportunity.

If you want to know more about the IPO process or how to apply for an IPO, you can ask me question.

Read More: What’s the Difference Between RHP and DRHP? (A Clear Explanation)

FAQs on IPO Process

Factors Influencing IPO Pricing?

The pricing of an initial public offering (IPO) is influenced by a range of factors, such as:

•The company’s financial performance over the last few years.

•The number of stocks issued in the IPO.

•The company’s potential growth rate.

•The company’s business model.

•The recent market price of companies listed on the stock exchange.

•The company’s competitive landscape.

•The company’s corporate story.

•The demand for the company’s shares.

•Use of Proceeds: The company’s intended use of IPO funds can influence pricing.

What are the methods of IPO pricing?

Different Methods of IPO Pricing:

Book Building: In India, the book-building method is commonly used for IPO pricing. Under this method, the company and its underwriters determine a price range within which investors can bid for shares. The final offer price is determined based on the demand generated during the bidding process. This method allows for price discovery and often results in a fair market-driven price.

Fixed Price: While less common, some IPOs are priced using a fixed-price method, where the issuer sets a specific price at which shares will be offered to the public. This method is simpler but may not always reflect market demand accurately.

Anchor Investors: Before the IPO opens to the public, anchor investors, typically institutional investors, are allotted shares at a predetermined price. This helps gauge investor interest and can provide stability to the IPO.